Property Overview

1 Havemeyer Lane

An exceptional retail investment opportunity in one of Connecticut’s most affluent and sought-after communities. This income-producing property is currently leased to a successful nail salon, offering immediate cash flow for investors seeking a stable 6% cap rate, and a low-maintenance commercial asset with minimal management responsibility.

Located on Havemeyer Lane in Greenwich, this retail space benefits from high visibility, excellent traffic flow, and easy accessibility, making it an attractive location for long-term tenants and business operators.

The combined zoning, GB (business) and R7 (residential), allows for a wide range of development opportunities.

Request More Information

Enter your contact details, and we’ll personally reach out to discuss the property and answer your questions.

Watch with sound for key insights on this investment

Investment Highlights

Turnkey Investment with Stable Income

Price: $1,425,000

Cap Rate: 6.0%

Property Type: Retail

Building Size: 1,726 SF + Basement Storage

Lot Size: 0.23 acres (Two lots: one for the building, one for parking)

Frontage: TBD

Zoning: GB (Building) & R-7 (Parking Lot)

Current Tenant: Tip Top Nails

Parking Spaces: 18±

Lease Terms: NNN (Triple Net)

Flood Zone: X (None)

Year Built: 1957

High Traffic, Convenient Location

Positioned on the Greenwich-Stamford border, this property benefits from steady consumer traffic drawn to the area’s essential retail and services. With a mix of fast food, grocery stores, pharmacies, medical offices, restaurants, and home improvement retailers nearby, this is a location people frequent out of necessity and convenience. Businesses in this corridor gain exposure to customers who are already in the area for daily errands, making it an ideal environment for service-based businesses that thrive on accessibility.

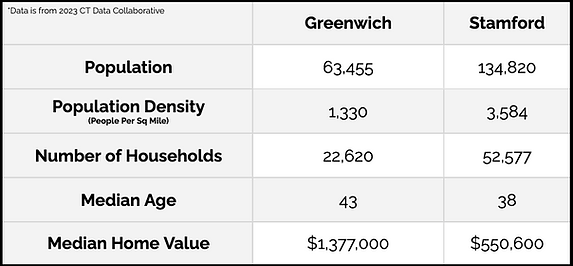

This property taps into the combined population of Greenwich and Stamford, nearly 200,000 residents, many of whom have high disposable incomes. Stamford, with its growing workforce and vibrant downtown, fuels additional foot traffic, while Greenwich provides a stable, affluent customer base. With seamless access from both towns, this location ensures strong visibility and a built-in stream of potential customers.

High Disposable Income

Greenwich and Stamford offer a powerful combination of affluence, population density, and consumer spending power, making this an ideal location for commercial investment. With a median household income of $180,447 in Greenwich and $99,791 in Stamford, both communities far exceed the national average of $80,610, ensuring strong local purchasing power.

The combined population of nearly 200,000 residents provides a steady customer base, while Greenwich’s high home values and older demographic indicate financial stability and discretionary spending. Stamford’s younger, densely populated workforce further fuels demand for retail and services. This location benefits from the economic strength of both towns, maximizing exposure and business potential.

Passive Investment

This property offers a stable 6% cap rate with low-maintenance and minimal management responsibilities making it an ideal choice for investors seeking passive income.

Leased to a single long-term tenant under a NNN (Triple Net) lease, the tenant is responsible for property taxes, insurance, and maintenance costs making this a low-risk, income-generating asset.

This investment not only provides immediate income stability but also offers the potential for future appreciation and redevelopment opportunities. The property’s zoning flexibility allows the possibility for both residential and commercial development.

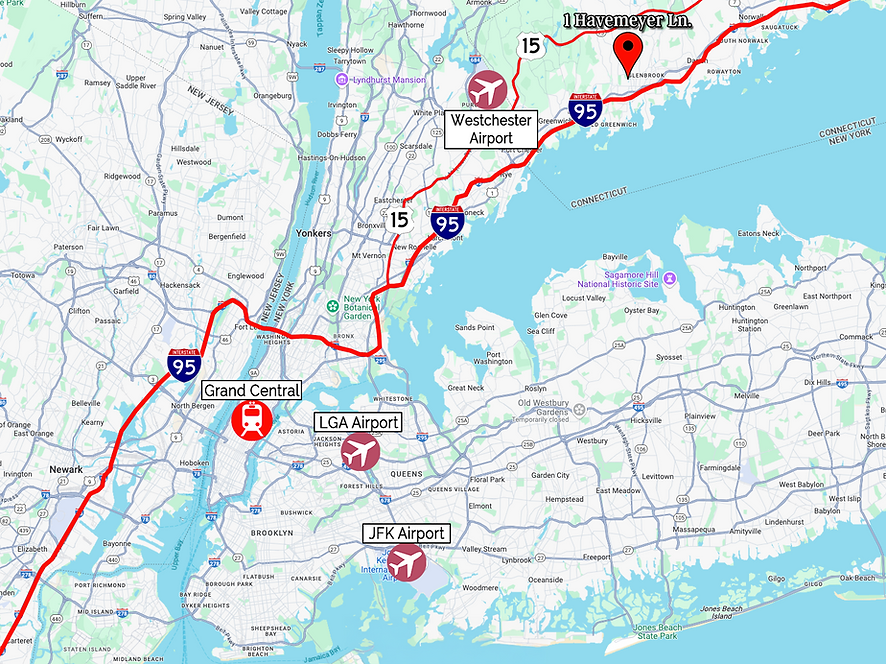

Regional

Located in the New York City metro area, this property offers exceptional regional access, making it a highly strategic investment. With major airports, highways, and direct rail connections nearby, businesses here can efficiently serve both local and regional customers while ensuring strong accessibility for employees and suppliers.

Distance to Notable Locations

Route 1 - 230ft

Old Greenwich Train Station - 1.1 Miles

I-95 - 0.9 Miles

Merritt Parkway - 4.6 Miles

Westchester County Airport - 12 Miles

LaGuardia Airport - 31.2 Miles

JFK Airport - 36 Miles

Strategic Location in NYC Metro

For commercial real estate investors, owning property in a high-traffic, well-connected area provides long-term stability, strong tenant demand, and predictable appreciation. Retail tenants prioritize locations that are easily accessible, as proximity to major highways, train stations, and airports increases customer flow and ensures strong business viability.

Additionally, being part of the NYC metro market means benefiting from one of the largest economic hubs in the world, where demand for retail and service-oriented spaces remains consistently high.